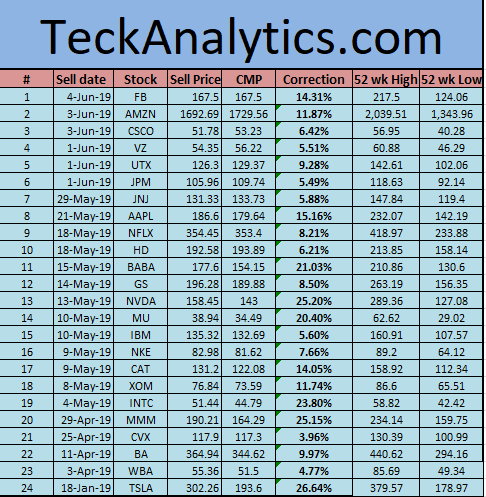

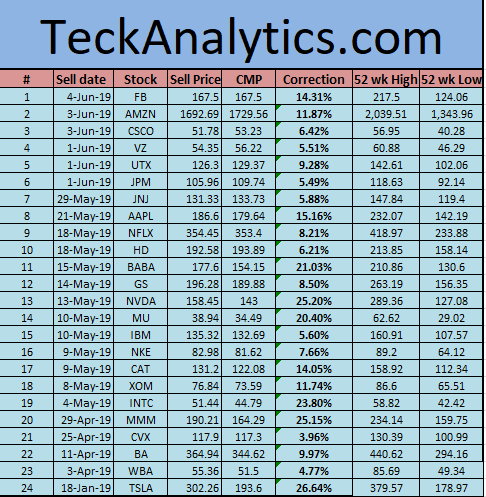

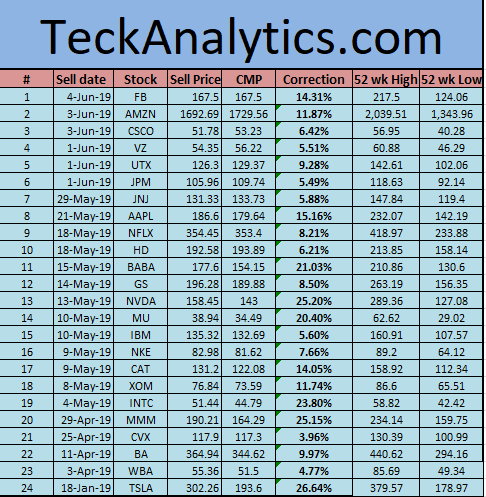

DOW & Nasdaq stocks correction/Bear Cycle started in last 60 days- April-June 2019

Dear Readers,

There are are four different type of stock phases in the stock market.

Bull means Buying

BreakOut- Heavy buying without any technical resistance

Bull Correction- Price correction

Bear- Hedging

What is a Bull Stock?

Bull cycle is considered when buyers are willing to pay higher price for a stock. Generally, there are more buyers than sellers in the market. It leads to higher price upward movements.

There could be many reasons for a Bull cycle i.e. great earning report, beating market/analyst expectations, positive future growth, rating upgrades, strong fundamental, technical, overall Bull market or sector or global reasons for a Bull cycle.

What is a Bull Correction Stock?

Stock is considered in Price/Bull correction when price drops down from the last Peak price. Generally 5%-14% is considered good price correction. Investors considered this as a good opportunity to invest money in the ongoing Bull stocks. This is also consolidation process where investors and FIIs, DIIs slowly keep buying and consolidate there stock position.

There is always risk of going Price correction stock into Bear Cycle if price goes down more than 20%.

What is a Breakout Stock?

Breakout stock situation is purely technical indicators driven. Whenever certain technical parameters fulfill the certain conditions, like Moving averages crossing each others. Stock tend to rise sharply in a few days to few weeks. Generally price 5% to 20% can be increased in few weeks.

What is a Bear Stock?

Bear cycle is considered when sellers are willing to accept lesser money for a stock. Generally, there are more sellers in the market than buyers. It leads to downward price movements for a Bear cycle, bad earning, negative future growth, rating downgrades, weak fundamentals, higher debts or interest payment, legal issue, technical, overall Bear market or sector or global

Dear Trader,

Stop loss values have multiple meanings and affects in trading. People who are holding a stock for long or a day trader and want to make maximum profit with exit strategy can have the tight stop loss. The moment Stop loss hit they are out.

There is always risk of keeping tight stop loss, if market opens lower than SL values, then there will be a whipsaw.

Some traders follow 2-3% or point values rule means if price fall more than that they are out of the market. Threy are traders who keep SL values at certain days/weeks/months MA, which is considered a safer practice for long term investors.

Price below stop loss may not call off the bull cycle. It can correct soon or act according to MA values. There are multiple other indicators/technical which have to be turned negative/positive to call Bull/Bear cycle off.

Other benefit of hitting stop Loss or price correction, People who are waiting to enter into a particular stock and waiting for price correction, they can take this opportunity to enter as price has dropped to MA 15/20. But again there is always possibility that It was not just a price correction basically downward price movement have started and more to happen which can offer much cheaper price for a stock.

People who are Long investors, may not keep DMA SL instead they keep WMA.