A

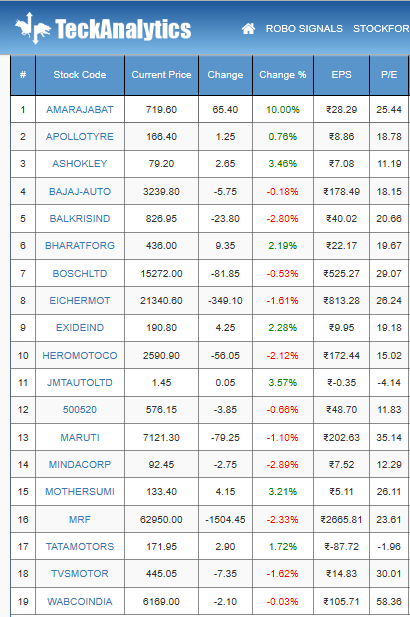

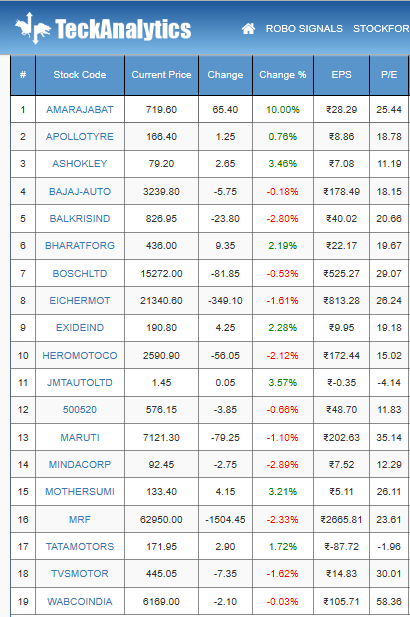

SHOKLEY and M&M both are quality stocks under 12 PE. Long term bets for investors.

A

SHOKLEY and M&M both are quality stocks under 12 PE. Long term bets for investors.

TeckAnalytics is looking to expand its product and services to its North American & global customers which requires VC funding mainly. If you happen to be VCs and interested to invest in our Startup, please feel free to contact us thru email- support@teckanaytics.com

Teckanalytics.com is now offering Mutual Fund & customized Portfolios to Buy/Sell/Hold calls based on Technical analysis. If you have or follow or invest SIP in any specific Mutual Fund and interested to trade MF portfolio stocks which are Fundamentally picked by MF managers.

Our software service can suggest you when to invest in MF stocks based on Technical charts which means you may be buying at bottom and selling at top.

Please contact on 9205492389 or reply to support@teckanalytics.com for detailed info.

www.Teckanalytics.com

How to Trade Live Bull/Breakout calls with limit or market price?

Every Day after market 7.30 pm IST we add new calls on website.

Log in to Teckanalytics.com and see Live calls and check for Bull/Breakout alerts.

You can buy latest calls of your choice at current price (means today’s closing price) or EMA3/EMA5 value from Exp moving average data.

See Axis is a Breakout call and today’s closing price 553.65.

Go to Exp Moving average data

Now we can place limit order AMO/BMO at Closing price 553.65 or EMA 3 (549.99) or EMA5 (547.44)

Paid members any queries, pls call or Email- Support@teckanalytics.com

Dear Member,

How to calculate Risk % ratio?

Log in with your valid id.

Go to the Live current Bull or Break Out alert page.

Click on the stock you want to trade.

See the Stock data

If EMA13% OR DMA15% value is below 3%. Your risk is 3%.

If EMA13% OR DMA15% more than 6%. Avoid Buy that stock as Bull or Breakout candidate. Risk is 6% or more.

Try to trade for the stock whose EMA5% or DMA5% is between -2% to 3% from the Bull or Breakout alert list.

Most of the trade range during day happen between EM3/DMA3 to EMA5/DMA5. For bigger Profit, EMA13/DMA15 values can be used to buy.

For Hedging- Calcualtion is same except -% to be considered for Risk.

Technical chart weekly review of NSE 200 BreakOut stocks with profit more than 10% within 3-4 weeks detected by Teckanalytics.com software.